This is the last part of our brief guide for first-time home buyers in South Carolina. Once you have closed on the purchase of your home, you will still need to take care of some very important details (in addition to your move):

This is the last part of our brief guide for first-time home buyers in South Carolina. Once you have closed on the purchase of your home, you will still need to take care of some very important details (in addition to your move):

1.Change all the utilities in your name. Usually sellers stop their accounts as of the closing date, sometimes they give you 1-2 days grace. The last thing you want is to get to your newly purchased home and find the power is off, and the temperature outside is 98F...

2.Re-key all exterior doors. Although the sellers may have seemed very nice, you never know who else has keys for the home. Don't forget to re-program the garage door openers!

3.If there was a tr...

You have finished performing your Buyer's Due Diligence and everything's lined up for a closing on a specific date and time (usually at the attorney's office). What happens at this "closing"?

You have finished performing your Buyer's Due Diligence and everything's lined up for a closing on a specific date and time (usually at the attorney's office). What happens at this "closing"?

OK - so you've hired a REALTOR, discussed your needs and buying criteria and got preapproved by a lender. Now it's time to go see homes! Although it is a relatively small city, the Charleston Metro Area is very large, with hundreds of neighborhoods, areas and subdivisions each with a different style, construction, lot size and price point.

OK - so you've hired a REALTOR, discussed your needs and buying criteria and got preapproved by a lender. Now it's time to go see homes! Although it is a relatively small city, the Charleston Metro Area is very large, with hundreds of neighborhoods, areas and subdivisions each with a different style, construction, lot size and price point.

The 4th annual Flip-Flop Ball benefiting

The 4th annual Flip-Flop Ball benefiting

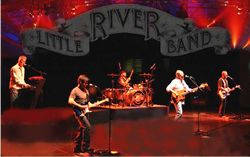

Boone Hall Plantation in Mt. Pleasant holds the Boone Hall Summer Concert Series.

Boone Hall Plantation in Mt. Pleasant holds the Boone Hall Summer Concert Series.  I thought that we had seen the last of the loans without income verification!

I thought that we had seen the last of the loans without income verification!

The Federal Government has been busy trying to regulate the mortgage industry to try to avoid the continuing debacle caused by the sub-prime mortgage debacle. In 2008, Congress passed the Home Ownership and Equity Protection Act (HOEPA) and the Housing and Economic Recovery Act (HERA). In addition, semi-public Fannie Mae and Freddie Mac adopted the Home Valuation Code of Conduct (HVCC). While better regulation is welcome (Canada, for example, had a better regulated banking/mortgage industry and as a result they are not experiencing the same problems the US is experiencing), but their implementation timing may affect (adversely) the swift recovery of the real estate industry. Here is a bri...

The Federal Government has been busy trying to regulate the mortgage industry to try to avoid the continuing debacle caused by the sub-prime mortgage debacle. In 2008, Congress passed the Home Ownership and Equity Protection Act (HOEPA) and the Housing and Economic Recovery Act (HERA). In addition, semi-public Fannie Mae and Freddie Mac adopted the Home Valuation Code of Conduct (HVCC). While better regulation is welcome (Canada, for example, had a better regulated banking/mortgage industry and as a result they are not experiencing the same problems the US is experiencing), but their implementation timing may affect (adversely) the swift recovery of the real estate industry. Here is a bri... Many parents would like to help their offspring become homeowners and realize the "American Dream". Here are a few tips that may help:

Many parents would like to help their offspring become homeowners and realize the "American Dream". Here are a few tips that may help: I just learned of a new version of a scam targeting prospective tenants and using real listings - here is how it works:

I just learned of a new version of a scam targeting prospective tenants and using real listings - here is how it works: Most of us REALTORS® are animal lovers and have pets of our own, but we also share many stories about showing homes where our clients went into a sneezing fit, we got bitten by a cantankerous furry creature, or opened the front door only to helplessly see a cute kitty scoot toward the nearest busy street.

Most of us REALTORS® are animal lovers and have pets of our own, but we also share many stories about showing homes where our clients went into a sneezing fit, we got bitten by a cantankerous furry creature, or opened the front door only to helplessly see a cute kitty scoot toward the nearest busy street. Experts agree that the inventory levels have to come down fot the housing market to start recovering. Short sales offer a win-win solution for buyers, sellers, lenders and agents, to speed up this recovery by selling inventory faster than by going the foreclosure/REO route.

Experts agree that the inventory levels have to come down fot the housing market to start recovering. Short sales offer a win-win solution for buyers, sellers, lenders and agents, to speed up this recovery by selling inventory faster than by going the foreclosure/REO route.