Getting the FUNDS to buy a home (unless you are paying cash) is one of the first steps that home buyers should complete.

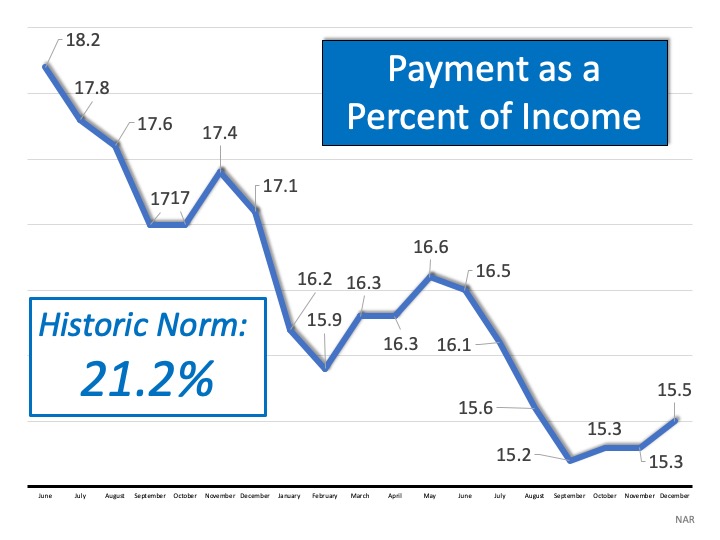

Mortgage rates are INCREDIBLY LOW right now (see below), so despite prices being high, homes are more AFFORDABLE now than ever before.

There are several types of MORTGAGE LOANS that are available, the ideal type for you depends on your CREDIT SCORE, the amount of money you have available for your DOWNPAYMENT, whether you are active or retired military, whether you are a first responder and whether the home is for your primary residence or not, among other things. Here are some of the most common types of loans/terms available:

- Fixed interest: 30-year fixed, 15-year fixed

- Variable interest: 5-1 Adjustable Rate Mortgage (ARM), 7-1 ARM

- Primary residence or second home/investment property

- Lot loans

- Construction, construction-to-perm

- HELOC (Home Equity Line of Credit)

- Renovation loan (like the FHA 203K)

- Reverse Mortgages

- HECM (Home Equity Conversion Mortgage - for purchase)

- VA Loans (up to 100% of the purchase price)

- FHA Loans (up to 96.5% of purchase price)

- Conventional Loans (up to 97% of purchase price to a limit of $510,400 (in the Charleston Tri-county area)

- Jumbo Loans (for amounts above $510,400)

You really need to talk to an experienced lender to figure out which loan is the BEST FOR YOU and your situation.

Is It Easy to Get a Mortgage Now?

Prior to 2006, anyone could qualify for a 100% loan, with very little income documentation. After the subprime mortgage meltdown, the pendulum has swung in the opposite direction and lenders are now very careful lending their money. They will ask lots of questions, request extensive paperwork and request explanations for seemingly insignificant aspects of the applicant's life and finances.

This does not necessarily mean that you need stellar credit and a 10-year employment history with a Fortune 500 company to qualify. There are still loans being approved with a credit score as low as 580, and you can still get 100% financing if you qualify for a grant or for a VA loan! However, it is ESSENTIAL to get a FULL DOC PRE-APPROVAL (not just a prequalification letter) before you start looking for homes. The last thing anyone wants is to find and negotiate the perfect home, just to find out the bank does not approve the loan!.... NEED HELP? PLEASE CLICK ON THE FORM BELOW TO GET ADDITIONAL INFORMATION.