When people are considering a move from another state or country to South Carolina, one of the questions they ask is what the tax rates are in the state.

Sales tax (called VAT or value-added tax in some places) is charged on consumption of goods (and only SOME services).

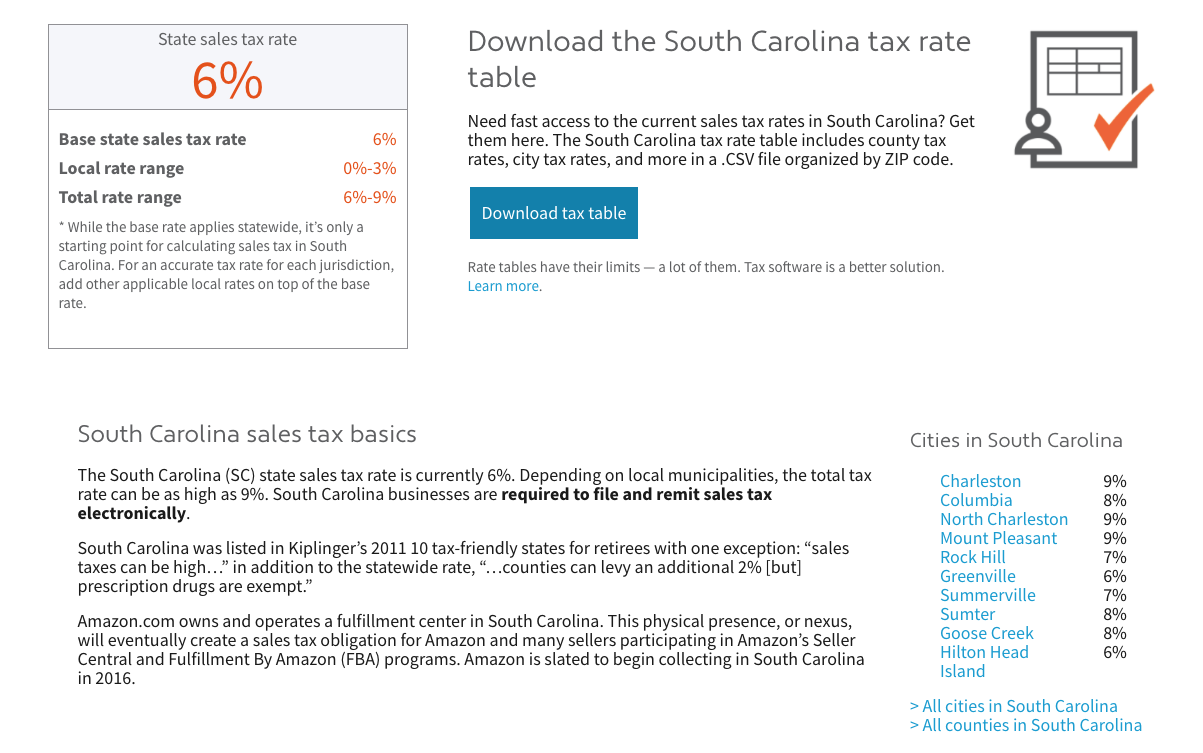

In South Carolina, the basic sales tax rate is 6%. In addition municipalities have the right to add local municipal taxes, so the total sales tax varies by city, and will range from 6% to 9%.

Here are the total sales tax for the main cities in SC (source: https://www.avalara.com/taxrates/en/state-rates/south-carolina.html)

What is Taxable?

Services in South Carolina are generally not taxable. So if you’re a freelance writer, graphic designer or a plumber, you’re in luck and you don’t have to worry about sales tax. But if the service you provide includes creating or manufacturing a product, you may have to charge sales tax on your products.

Tangible products are taxable in South Carolina , with a few exceptions. These exceptions include certain groceries, prescription medicine and medical devices, and machinery and chemicals used in research and development. (source: https://www.taxjar.com/states/south-carolina-sales-tax-online/#is-what-youre-selling-even-taxable)

Please contact us if you have any questions or comments.