Charleston SC Mid-Year Real Estate Market Update

Highlights

Highlights

(click graphs & charts to enlarge)

- The Charleston Area is experiencing high growth, and our real estate market is hot. We are in a clear "seller's market" with 3.4 Months of Inventory.

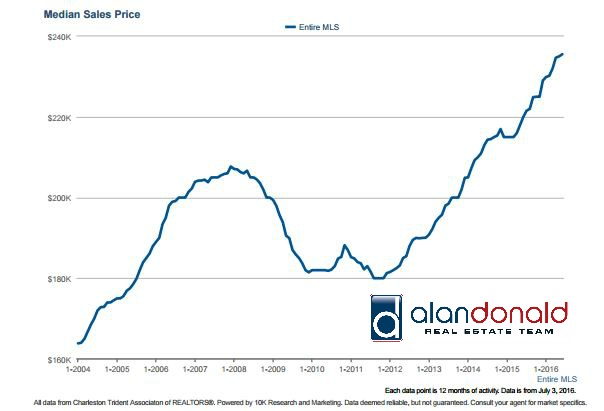

- Median home price is up to $249,500. The cheapest home sold in the last 6 months for $10,000 in Walterboro. The most expensive home sold for $7.51M in Downtown Charleston.

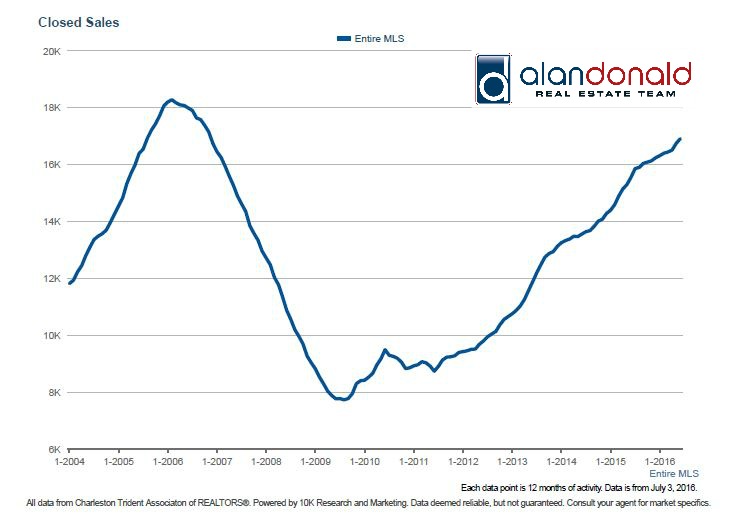

- Selling activity has been brisk: 8,700 homes sold in the first half of the year, up by 10% over 2015.

- The average home in Charleston SC sells in 55 days and for 97% of list price

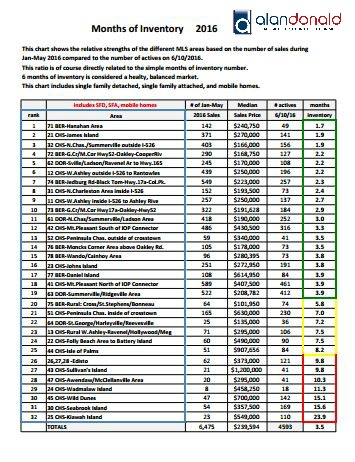

- The "hottest" areas of Charleston as of June 2016 were: Hanahan, James Island, and N. Charleston/Summerville Outside of I-526. The "weakest" areas were: Wild Dunes, Seabrook and Kiawah.

- The Mount Pleasant market appears to be experiencing a market shift, which may signal an upcoming shift for the Charleston market in the future.

Mount Pleasant - Shifting Market?

In Mount Pleasant we have experienced unusually low showing activity since mid-May. It is hard to pinpoint what is causing this reduced activity, if it's election jitters, vacation mood or price pushback from buyers. We also don't know if this is a temporary glitch, or if it signals a market correction to come.

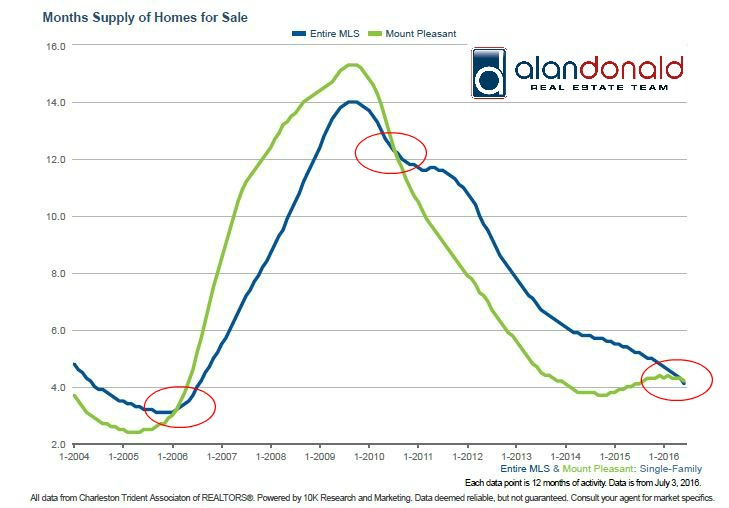

The real estate market shifts cycles when the relationship between supply and demand changes. In real estate we call this index "Absorption" or "Months of Inventory" (MOI).

Although inventory in Mount Pleasant is still low, it appears that demand has fallen to where the MOI index is rising.

Also, this time of the year should be the busiest In terms of homes going under contract, as many buyers want to move during the summer.

Also, this time of the year should be the busiest In terms of homes going under contract, as many buyers want to move during the summer.

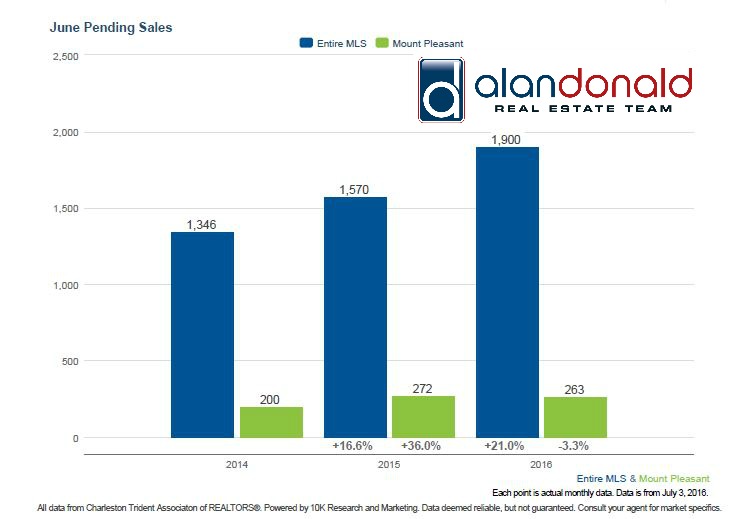

However the June Pending Sales graph shows that the number of properties going under contract is down from the same time last year, which is very unusual. The rest of the Charleston area is booming, pending sales show a substantial increase year-over-year.

However the June Pending Sales graph shows that the number of properties going under contract is down from the same time last year, which is very unusual. The rest of the Charleston area is booming, pending sales show a substantial increase year-over-year.

Local real estate market dynamics have shown that traditionally all the trends start in Mount Pleasant and then filter through to the rest of the areas, with a lag of 1-1.5 years.

The Months of Supply graph shows absorption for Mt. Pleasant vs. the Charleston MLS. In the past, when the two curves have intersected, this has signaled a impending shift in the market. At the beginning of 2006 they intersected, and the Mt Pleasant market shifted abruptly in March of 2006 when activity decreased markedly and inventory shot up. In 2011 they intersected again, and the Mt. Pleasant market led the recovery, when the rest of the metro area (except for Daniel Island, which generally follows Mount Pleasant closely) kept high inventory until about a year and a half ago.

The Months of Supply graph shows absorption for Mt. Pleasant vs. the Charleston MLS. In the past, when the two curves have intersected, this has signaled a impending shift in the market. At the beginning of 2006 they intersected, and the Mt Pleasant market shifted abruptly in March of 2006 when activity decreased markedly and inventory shot up. In 2011 they intersected again, and the Mt. Pleasant market led the recovery, when the rest of the metro area (except for Daniel Island, which generally follows Mount Pleasant closely) kept high inventory until about a year and a half ago.

Right now we are at another crossroads. At the end of the summer sellers who need to sell and have not sold will start dropping their prices and we may see inventory in Mount Pleasant start going up.

What to do about all this?

I have always maintained that, unless they are in the business of flipping homes, buyers should always keep a long term horizon for the purchase of a home or for investing in real estate. The real estate market is cyclical, and as such it will have ups and downs. In the long term, U.S. real estate has historically appreciated by 3%-4% per year.

In addition, I believe that the demographic and economic fundamentals for Charleston are stronger than the average for the U.S.: The city's population is growing, it is attracting employers and creating well paid jobs, it has won all kinds of accolades as one of the best cities to retire in, one of the most attractive cities for Millenials, and one of the top tourist destinations in the World. Which means demand for housing in Charleston will remain strong.

Long term, I'm not worried!

Contact us on 843-900-0155 with any questions.

Please contact us if you have any questions or comments.