Our local paper, The Post & Courier, reports that average dwelling rental in Charleston is $400 above the national average, with the median rental rate for a one-bedroom apartment now standing at $1,446 and $1,690 for a two-bedroom (the national average rental

for a two-bedroom apartment is $1,294). Rental rates were just starting to rise at this time last year after the widespread availability of COVID vaccines allowed renters who had returned home to live with family members to begin to move back into their own apartments.

Mount Pleasant has the most expensive rental rates in South Carolina, with a median rental of $1,868 for a one-bedroom unit and $2,146 for a two-bedroom dwelling, which increased by 18.8 percent in the last 12 months.

In North Charleston rental rates are a bit cheaper, though rates did jump up by 20.4 percent in the same period. Renting a one-bedroom unit in North Charleston costs $1,244 per month while a two-bedroom costs $1,406, based on the median rental rates.

Rents continue to trend upward, and though the pace has decreased, rent growth is still outpacing pre-pandemic levels for apartment dwellers across the country, according to Apartment List.

Buy vs. Rent?

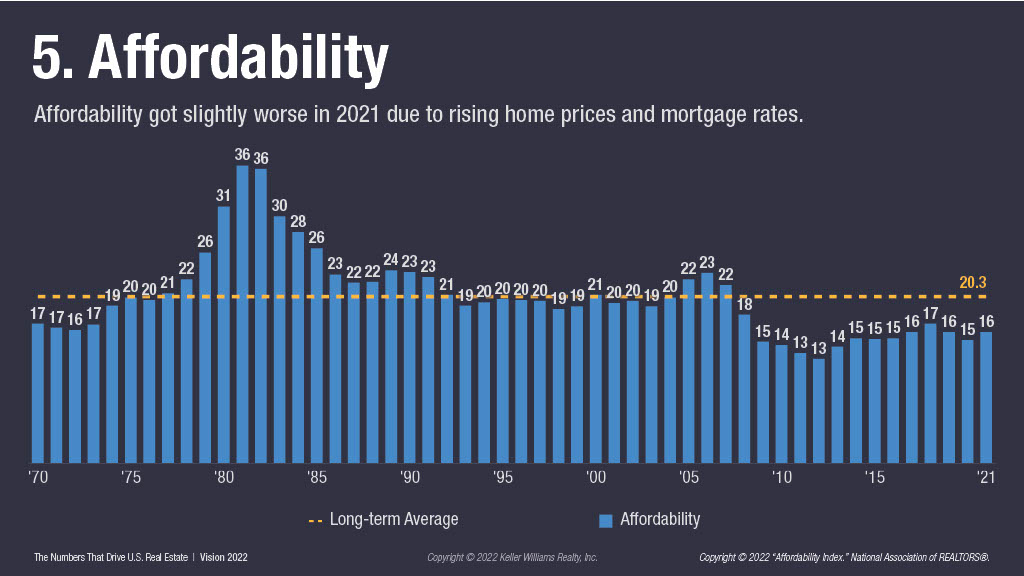

By comparison, although prices of condos and townhouses have also increased, affordability to purchase is still reasonably good in historical terms.

The following chart shows housing affordability in the US since 1970.

Take the following examples:

North Charleston:

The median price for a 2-bedroom condo in North Charleston is $191K. If a buyer borrows 80% at 4.5% for 30 years, the principal and interest payment is $774/mo. Add the regime fees ($260/mo.) plus taxes ($700/yr) and HO6 insurance ($500/yr.), the total payment will be around $1,134 per month (compared to median rent of $1,244).

Mount Pleasant:

The median price for a 2-bedroom condo in Mount Pleasant is $321K. If a buyer borrows 80% at 4.5% for 30 years, the principal and interest payment is $1,301/mo. Add the regime fees ($350) plus taxes ($1200/yr) and HO6 insurance ($700/yr), the total payment will be around $1,809 per month (compared to median rent of $2,146).

So just on the financials (without counting the TAX DEDUCTION that homeowners get for interest paid to the lender on their primary residence) it still makes a lot of sense to buy a home. In addition to the financial advantages, homeowners get:

- More control over their long term expenses (the only items that will increase are the property taxes and the insurance rates. The loan payments stay the same for 30 years). Rental rates are out of the renters' control.

- Long-term capital appreciation (the average appreciation of residential real estate in the U.S. has been 4% per year)

- Capital gain exemption on the gain when you sell the property ($250K for a single person and $500K for a married couple)

- A voice and a vote in the administration of the homeowners or condominium association

- Fewer restrictions than those imposed by landlords

Questions?

Eager to start your home purchasing process?

Please contact us on 843-900-0155 to have an informal chat.