Home Affordability

Watch this video to hear me discuss the recent increase in interest rates!

Help me buy a home!

Affordability has two components:

1. Market price for the homes

2. Interest rate for the mortgage loans

As you know, the Federal Reserve announced last week that they will stop buying long-term bonds and that created almost a one percent hike in interest rates for mortgages. What does that mean for you?

In the Real Estate market prices are starting to climb back up again. With interest rates on the rise buyers across the U.S. should be feeling more pressure to act sooner, rather than later, as the expectation is for home prices to rise...

Every 1% rise in mortgage interest rates erodes more than 10% of the buyer's purchasing power!

For example, if you were calculating to have a monthly payment of say $2,000 a month, at what percent increase in interest rate would reduce your affordability by about $50,000? This is important to consider!

Below is a table that depicts the impact a 1% increase in interest rates will have on your borrowing ability and ultimately your home affordability.

*These numbers and figures are example projections calculated by The Alan Donald Real Estate Team.

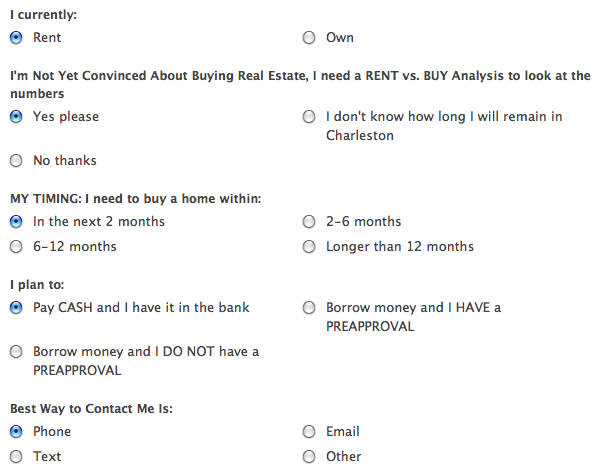

If you would like to know more about what you can afford please fill out the form below and we will be glad to help you! Also, feel free to give us a call, (843) 900-0155.

Have a wonderful day!

Please contact us if you have any questions or comments.