Foundation For A Mortgage (Key Items Lenders Look For In A Mortgage Application)

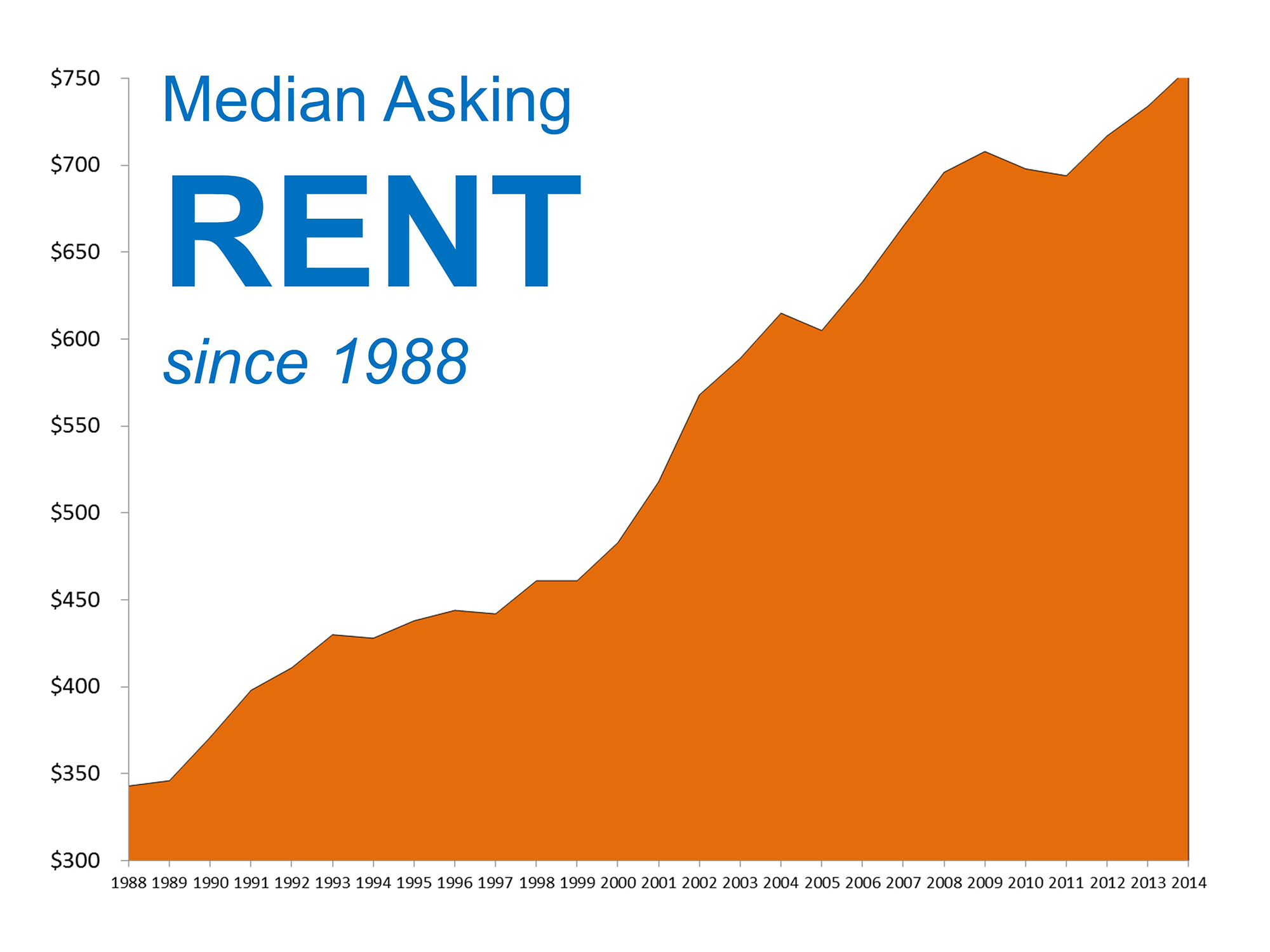

If you are still renting, the above graph shows half of the story of why you may wish to consider buying a home (the other half is the prevailing low interest rates on mortgage loans). Bobby Green, an experienced mortgage lender with Starkey Mortgage, sent us this information that we thought would be useful for anyone getting (or thinking about getting) a mortgage loan.

1. CREDIT – Does the borrower’s credit meet the minimum guidelines? Is the credit score above the minimum? Are their any liens or judgments? The minimum credit score for Conventional is 620 (without MI) 660 with MI. FHA goes down to 580. VA requires a 620. USDA requires a 640.

2. INCOME – How is the borrower paid? W-2/Salary or 1099/Self-Employed? Hourly or Salary? Bonus or Commissions? Does the borrower’s income keep the Debt-to-Income (DTI) ratio in line? *Conventional cannot be over 45% DTI, FHA cannot be over 50% DTI with the new mortgage payment.*

3. LOAN TO VALUE – How much is the borrower putting as a down payment? Conventional requires at least 5%. FHA requires at least 3.5% (with a 620 score). VA and USDA allow 100% Financing. JUMBO’s require 10%.

4. RESERVES – Does the borrower have money left over after the down payment? This strengthens the file. FHA does not require reserves. Conventional requires 2 months' worth of PITI (Principal, Interest, Taxes and Insurance) payments.

Fill out this form to request your FREE, NO-OBLIGATION mortgage consultation...

Please contact us if you have any questions or comments.